Pay at Closing Home Inspection – Buyer Impact Explained

- Matt Cameron

- 1 day ago

- 6 min read

Thinking about buying your first home in Baldwin County can feel overwhelming, especially when it comes to understanding inspection payments and closing costs. Managing your budget is often a top concern, and choosing a pay at closing home inspection may offer real flexibility during this exciting but stressful process. By learning how this payment method changes both your upfront expenses and your final negotiations, you can move forward with confidence and avoid last-minute surprises before you get the keys.

Table of Contents

Key Takeaways

Point | Details |

Pay at Closing Concept | A pay at closing home inspection allows buyers to defer inspection fees until closing, integrating them into closing costs for financial flexibility. |

Buyer Responsibilities | Homebuyers must ensure clear communication and documentation with inspectors and lenders regarding payment arrangements. |

Qualification Criteria | To qualify, buyers need an approved mortgage, inspection contingency, and compliance with specific lender conditions. |

Legal and Documentation Risks | Buyers should maintain thorough records and obtain written agreements to avoid potential legal pitfalls and transaction delays. |

What Is Pay at Closing Home Inspection

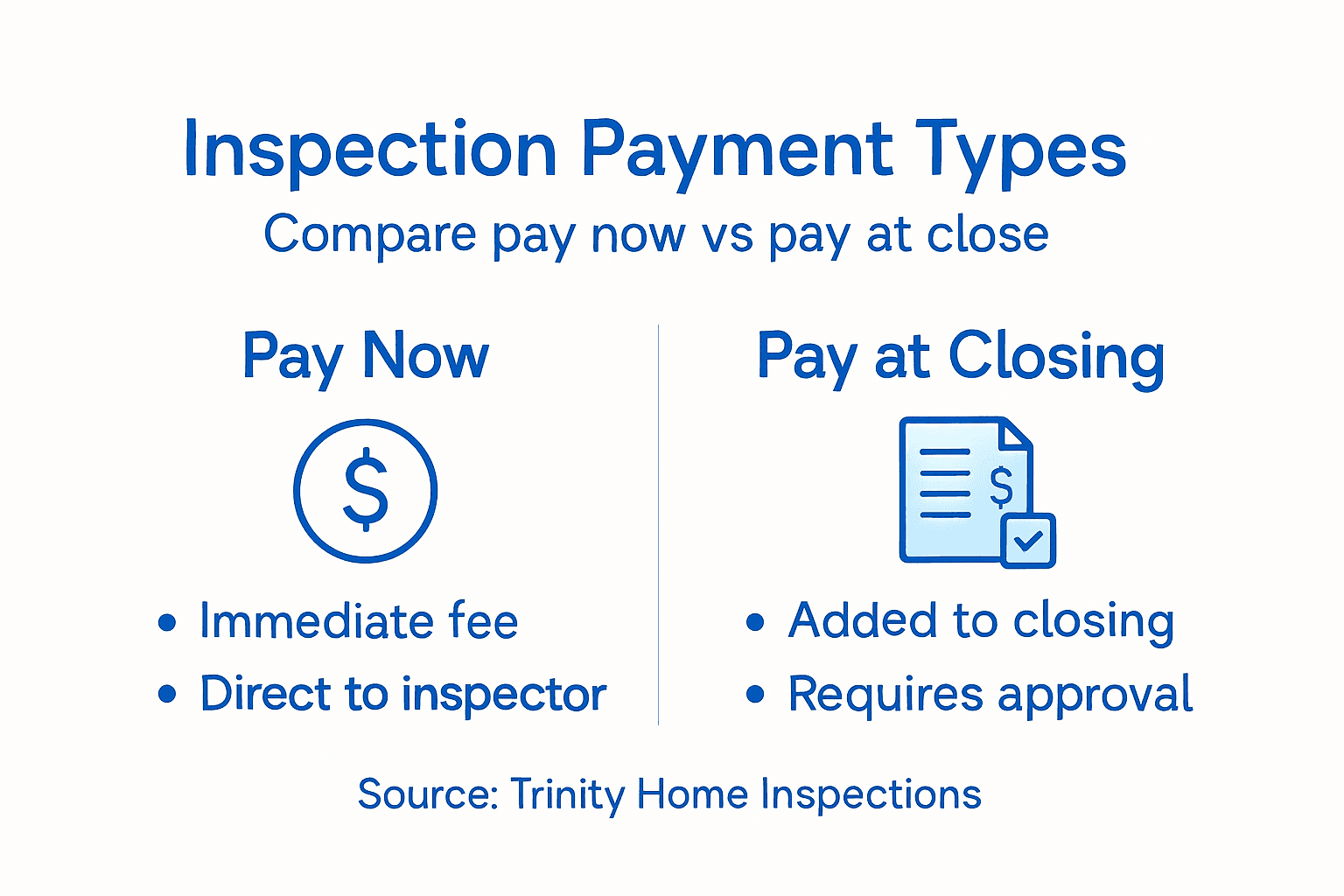

A pay at closing home inspection is a specialized service that allows homebuyers to defer their home inspection payment until the final closing of their real estate transaction. Unlike traditional inspection models where buyers pay immediately after the service, this approach integrates the inspection fee directly into the closing costs, offering financial flexibility during the home purchase process.

The core concept of pay at closing involves several key characteristics:

The home inspection fee is rolled into the overall closing costs

Payment is delayed until the property’s final settlement

Reduces upfront out-of-pocket expenses for homebuyers

Typically requires prior agreement between the inspector and buyer

Home closing costs can include multiple components, and incorporating the inspection fee into this process provides several strategic advantages. By integrating the inspection payment with other transaction expenses, buyers can manage their immediate financial resources more effectively.

Homebuyers should understand that while this payment method offers convenience, it requires careful documentation and clear communication with both the home inspector and the mortgage lender. Paid Outside of Closing (POC) processes highlight the importance of transparent financial arrangements to ensure smooth transaction processing.

Here is a comparison of traditional home inspection payments versus pay at closing payments:

Feature | Traditional Payment | Pay at Closing Payment |

Payment Timing | Immediately after service | At final closing |

Upfront Cash Needed | Required | Often not required |

Impact on Buyer’s Cash Flow | Reduces cash reserves | Preserves cash for purchase |

Closing Paperwork Complexity | Minimal | May require extra documentation |

Lender Involvement | Not involved | Must be notified/approve |

Pro tip: Always confirm the specific payment terms and get written agreement about the pay at closing arrangement before scheduling your home inspection to avoid potential misunderstandings.

How the Process Works for Alabama Buyers

In Alabama, the pay at closing home inspection process follows a structured workflow that provides buyers with flexibility and protection during their real estate transaction. Home inspection regulations ensure that buyers receive comprehensive property evaluations before finalizing their purchase, with specific guidelines governing how inspections are conducted and paid for.

The typical process for Alabama buyers involves several key steps:

Select a licensed home inspector

Schedule the inspection during the contract’s contingency period

Coordinate payment method (traditional or pay at closing)

Review detailed inspection report

Negotiate repairs or adjust purchase terms if needed

Buyers have multiple payment options when working with home inspectors in Alabama. Home buying support recommends understanding all financial arrangements before closing, including how inspection fees will be handled.

Alabama-specific considerations for pay at closing home inspections include verifying that the mortgage lender approves this payment method and ensuring all documentation is properly prepared. Some lenders may have specific requirements about how inspection fees are integrated into the closing costs.

Pro tip: Request a written agreement from your home inspector that clearly outlines the pay at closing terms to prevent any misunderstandings during the transaction.

Key Benefits and Drawbacks to Know

The pay at closing home inspection approach offers Alabama homebuyers a unique set of advantages and potential challenges that require careful consideration. Buyer transaction flexibility plays a crucial role in understanding these nuanced financial arrangements.

Key benefits of pay at closing home inspections include:

Reduced upfront out-of-pocket expenses

Enhanced financial management during home purchase

Simplified transaction paperwork

Potential alignment with mortgage closing processes

Preservation of immediate cash reserves

However, potential drawbacks demand equally thorough examination. Seller repair credits can introduce complex documentation requirements that buyers must navigate carefully. Some lenders have strict guidelines about how inspection fees are integrated into closing costs, which could potentially complicate the transaction.

Professional home inspectors recommend thoroughly discussing payment structures with both the inspector and mortgage lender beforehand. Understanding the specific terms, potential limitations, and documentation requirements can help prevent unexpected complications during the home purchasing process.

Pro tip: Obtain written documentation from your home inspector and mortgage lender that explicitly outlines the pay at closing inspection terms to ensure complete transparency and avoid potential misunderstandings.

Who Qualifies and What Lenders Require

Qualifying for a pay at closing home inspection depends on several critical factors that Alabama homebuyers must carefully navigate. Home inspection legal requirements vary depending on the type of mortgage and specific lender standards, making it essential to understand the qualification criteria.

Typical qualification requirements include:

Approved mortgage application

Purchase contract with inspection contingency

Lender-approved property condition standards

Sufficient credit score

Documented income and employment

Acceptable debt-to-income ratio

Government-backed loans like FHA and VA have additional specific requirements. These loans often mandate comprehensive property evaluations to ensure the home meets strict habitability and safety standards. Closing cost disclosures provide critical documentation that outlines all inspection-related fees and requirements.

Mortgage lenders typically assess several factors when determining whether a pay at closing home inspection will be permitted. These include the buyer’s credit profile, the specific property’s condition, and the overall risk assessment of the loan. Some lenders may require additional documentation or have more stringent guidelines about how inspection fees can be integrated into the closing costs.

Pro tip: Request a detailed written explanation from your lender about their specific requirements for pay at closing home inspections to ensure full compliance and avoid potential transaction delays.

Make Pay at Closing Home Inspections Easy with Trinity Home Inspections

Navigating the complexities of a pay at closing home inspection can be stressful. You want clear protections for your investment without upfront cash strain. At Trinity Home Inspections, we understand these challenges and provide InterNACHI-certified inspections that give you the clarity to proceed confidently. Our same-day photo and video-rich reports, including free thermal imaging, ensure you get actionable insights that protect your home purchase and your wallet.

Whether you need thorough roof inspections with FAA drone technology or detailed reports to satisfy your lender’s requirements, Trinity offers trustworthy, faith-based professionalism across Baldwin, Mobile, and the Gulf Coast Alabama area. Avoid surprises, streamline your closing process, and preserve your cash flow all while trusting an inspected home backed by certified expertise.

Secure your home inspection with a company that values integrity, transparency, and your peace of mind. Visit Trinity Home Inspections today to schedule your service and learn how our detailed inspection process supports Alabama homebuyers choosing pay at closing options. Get the confidence you deserve and make your next home decision with certainty.

Explore how our professional inspections align with your homebuying needs here: Trinity Home Inspections, Home Inspection Benefits, and Contact Us.

Frequently Asked Questions

What is a pay at closing home inspection?

A pay at closing home inspection allows homebuyers to defer the inspection payment until the final closing of their real estate transaction, rolling the fee into the overall closing costs.

What are the benefits of using a pay at closing home inspection?

The main benefits include reduced upfront out-of-pocket expenses, enhanced financial management during the home purchase, and simplified transaction paperwork.

What does the process involve for buyers selecting a pay at closing inspection?

The process typically involves selecting a licensed home inspector, scheduling the inspection during the contract’s contingency period, coordinating the payment method, and reviewing the inspection report to negotiate repairs if necessary.

Are there any drawbacks to pay at closing home inspections?

Potential drawbacks include additional documentation requirements, the need for lender approval, and the risk of complications if the payment terms are not clearly documented and communicated.

Recommended