What Is a Homebuyers Survey? The Power to Protect You

- Matt Cameron

- 10 hours ago

- 8 min read

Buying your first home in Baldwin or Mobile County can feel overwhelming when you are unsure what lies beneath the surface of a property. The reality is, hidden issues or costly repairs can turn an exciting purchase into a financial headache if left undiscovered. A homebuyer survey gives you an expert, detailed look at a home’s true condition, equipping you with the knowledge and negotiation power you need to move forward with confidence.

Key Takeaways

Point | Details |

Importance of Homebuyers Surveys | Homebuyers surveys provide a detailed examination of a property’s condition, uncovering hidden issues, which can ultimately save buyers significant repair costs. |

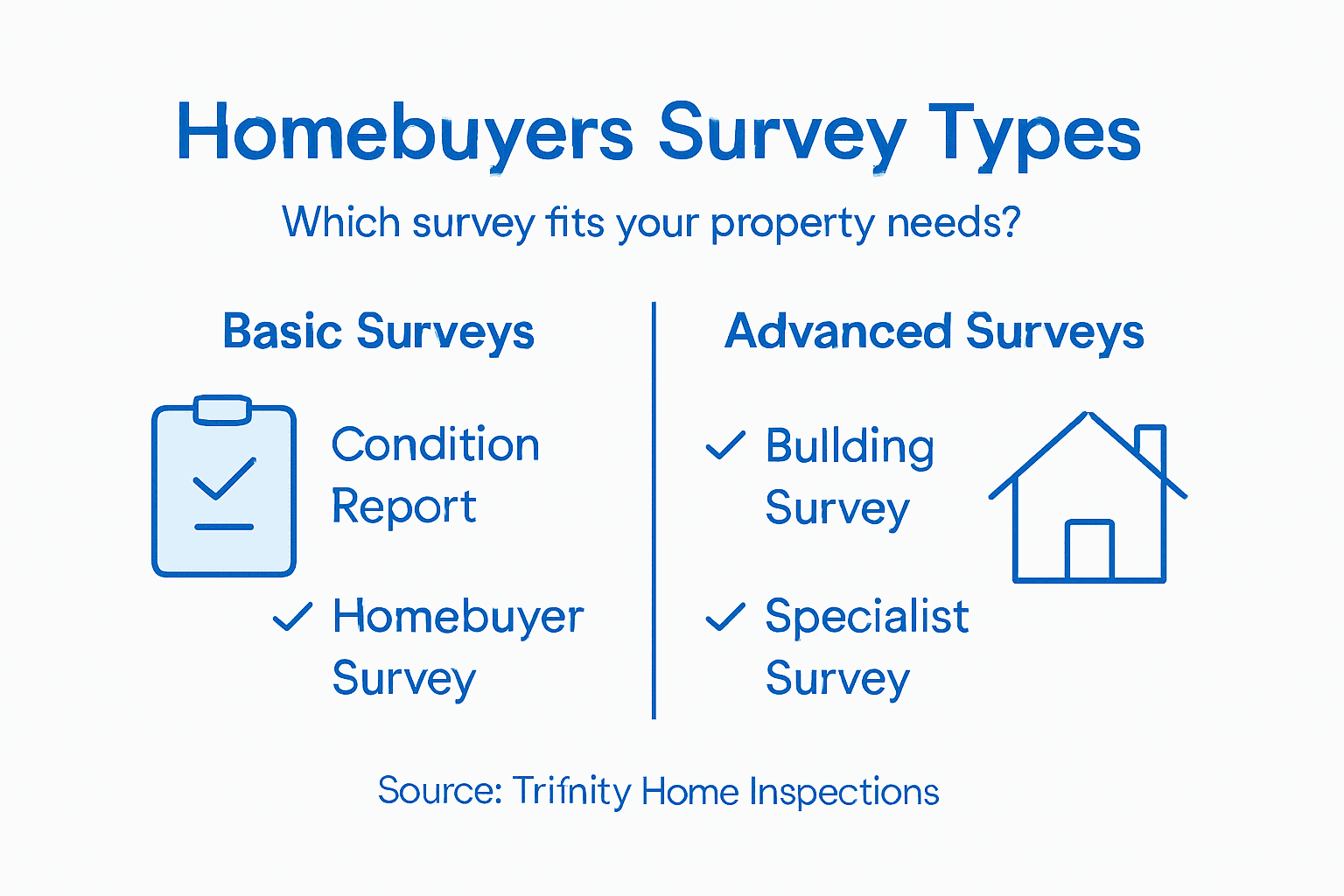

Types of Surveys | Different survey types serve unique purposes, from basic Condition Reports to comprehensive Building Surveys, allowing buyers to match the survey to the property’s age and complexity. |

Survey Process | The survey process includes stages such as initial consultation, physical examination, and report generation, ensuring a thorough understanding of the property’s state. |

Benefits and Limitations | While comprehensive surveys offer transparency and negotiation power, buyers should recognize inherent limitations, including potential oversights and the inability to predict future issues. |

What a Homebuyers Survey Really Means

A homebuyers survey is far more than a simple checklist - it’s your strategic defense against potential hidden property issues. Comprehensive housing surveys reveal critical insights that can save homebuyers thousands of dollars in unexpected repairs and future complications.

At its core, a homebuyers survey represents a professional, detailed examination of a property’s physical condition, going well beyond surface-level observations. The survey provides an independent, expert assessment that uncovers potential structural problems, maintenance requirements, and potential safety hazards that might not be immediately visible during a standard walkthrough.

Key elements a comprehensive homebuyers survey typically investigates include:

Structural integrity of walls, foundations, and roofing

Evidence of water damage or potential moisture intrusion

Electrical system functionality and potential hazards

Plumbing system condition and potential repair needs

Insulation and energy efficiency assessment

Signs of pest infestation or potential environmental risks

Professional inspectors use specialized tools and techniques to conduct thorough evaluations, providing homebuyers with a transparent understanding of the property’s actual condition. Buyer behavior insights suggest that informed purchasers who invest in comprehensive surveys make more confident and financially sound decisions.

Beyond identifying immediate issues, a homebuyers survey offers long-term strategic advantages. The detailed report becomes a powerful negotiation tool, potentially enabling price adjustments, requesting repairs before purchase, or even walking away from a property with significant undisclosed problems.

Pro tip: Request a sample inspection report from your chosen home inspector to understand the depth and clarity of documentation you can expect.

Different Types of Homebuyer Surveys Explained

Homebuyer surveys are not one-size-fits-all. Diverse survey methodologies reveal multiple approaches tailored to different property types and buyer needs. Understanding these variations can help you select the most appropriate survey for your specific real estate investment.

The primary types of homebuyer surveys typically include:

Condition Report: A basic survey providing a general overview of the property’s condition

Homebuyer Survey: A more detailed examination of visible and accessible areas

Building Survey: The most comprehensive option, offering an in-depth analysis of the entire property

Specific Purpose Surveys: Targeted assessments for unique property characteristics

Professional home inspectors recognize that each survey type serves a distinct purpose. A housing market analysis demonstrates that different survey levels can dramatically impact purchasing decisions.

The Condition Report represents the most basic survey, offering a surface-level assessment of the property’s apparent condition. It’s typically recommended for newer properties or those in seemingly good condition. The Homebuyer Survey provides a more comprehensive evaluation, investigating potential structural issues, major defects, and areas of immediate concern.

For older or more complex properties, the Building Survey offers the most exhaustive examination. This comprehensive assessment includes detailed insights into the property’s construction, potential hidden issues, and long-term maintenance considerations. Specialized surveys can also target specific concerns like pest infestation, environmental hazards, or structural integrity.

Pro tip: Always match the survey type to your specific property’s age, condition, and potential complexity to ensure you’re getting the most appropriate level of investigation.

Here is a quick comparison of the main types of homebuyer surveys and their ideal use cases:

Survey Type | Depth of Inspection | Best for Property Type | Typical Buyer Need |

Condition Report | Basic visual review | Newer or well-maintained homes | Quick reassurance |

Homebuyer Survey | Moderate inspection | Average-aged homes, some visible issues | Balanced detail and cost |

Building Survey | Full, in-depth analysis | Older or renovated properties | Comprehensive understanding |

Specific Purpose Survey | Targeted assessment | Unique structures or specialized issues | Addressing known concerns |

How the Homebuyers Survey Process Works

The homebuyers survey process is a strategic journey designed to provide comprehensive insight into a property’s condition. Homebuyer purchase steps outline a systematic approach that transforms property evaluation from a simple checklist to a critical decision-making tool.

Typically, the homebuyers survey process follows these key stages:

Initial Consultation: Discussing survey scope and specific property concerns

Property Preparation: Ensuring accessible areas for thorough inspection

Physical Examination: Comprehensive property assessment

Report Generation: Detailed documentation of findings

Results Review: Discussing implications and potential next steps

Professional surveyors follow a meticulous survey methodology that ensures no critical detail is overlooked. The physical examination typically involves carefully inspecting both visible and accessible areas of the property, using specialized tools to detect potential issues.

During the survey, inspectors systematically evaluate structural elements, electrical systems, plumbing, roofing, and other critical components. They use moisture meters, thermal imaging cameras, and other advanced diagnostic tools to uncover hidden problems that might not be apparent during a casual walkthrough. This detailed examination provides buyers with a comprehensive understanding of the property’s true condition.

The final report serves as a critical document, offering a detailed breakdown of the property’s condition, potential repair needs, and estimated maintenance costs. This information becomes an invaluable tool for negotiation, helping buyers make informed decisions about their potential real estate investment.

Pro tip: Always request a sample of the inspector’s previous reports to understand the depth and clarity of documentation you can expect.

Key Benefits and Limitations for Buyers

Homebuyer surveys provide critical insights, but they also come with inherent benefits and potential limitations. Housing market challenges demonstrate that understanding these nuances can significantly impact a buyer’s decision-making process.

Key benefits of a comprehensive homebuyers survey include:

Transparency: Uncovering hidden property issues

Financial Protection: Identifying potential costly repairs

Negotiation Power: Providing leverage in purchase price discussions

Risk Mitigation: Understanding long-term property maintenance needs

Informed Decision-Making: Comprehensive property evaluation

Professional inspections reveal both strengths and potential constraints. Buyer market dynamics highlight that while surveys provide valuable information, they are not absolute guarantees of a property’s condition.

Limitations of homebuyer surveys can include potential oversights in areas that are not easily accessible, such as internal wall cavities, underground utilities, or complex structural elements. Some surveys may have scope restrictions, meaning certain specialized assessments like detailed pest inspections or comprehensive environmental testing might require additional specialized examinations.

Moreover, while surveys provide a snapshot of a property’s condition at a specific moment, they cannot predict future issues or guarantee against potential future problems. Buyers should view the survey as a valuable tool for understanding a property’s current state, but not as an absolute insurance against all potential future maintenance or structural challenges.

Pro tip: Always request a detailed discussion with your inspector about the survey’s specific limitations and what additional specialized inspections might be recommended for your particular property.

Costs, Legal Requirements, and Common Pitfalls

Housing market challenges reveal the complex financial landscape surrounding homebuyer surveys. Understanding the costs, legal intricacies, and potential pitfalls is crucial for making an informed real estate investment.

Typical costs associated with homebuyer surveys include:

The following table summarizes potential survey costs and what influences the price:

Survey Type | Typical Cost Range | Cost Factors |

Condition Report | $250–$500 | Property size, age |

Homebuyer Survey | $500–$800 | Complexity, location |

Building Survey | $800–$1,500 | Property size, age, construction |

Specialized Inspection | $100–$300/service | Scope, follow-up needs |

Basic Condition Report: $250-$500

Homebuyer Survey: $500-$800

Comprehensive Building Survey: $800-$1,500

Additional Specialized Inspections: $100-$300 per service

Potential Follow-up Investigations: Varies based on initial findings

Legal requirements vary by state and locality. Homebuyer assistance programs demonstrate that different jurisdictions have unique regulations governing home inspections, disclosure requirements, and buyer protections.

Common pitfalls buyers encounter include underestimating the true cost of property maintenance, misinterpreting survey results, or failing to budget for potential repairs identified during the inspection. Some buyers mistakenly view the survey as a guarantee of future property condition, rather than a snapshot of the current state.

Additional legal considerations involve understanding the scope of the survey’s liability, interpreting professional recommendations, and knowing which issues might constitute grounds for further negotiation or contract renegotiation. Professional inspectors provide crucial insights, but buyers must remain proactive in understanding the limitations of their survey.

Pro tip: Budget an additional 10-15% beyond the survey cost for potential follow-up investigations or recommended repairs.

Protect Your Investment with a Trusted Homebuyers Survey Partner

Understanding the true condition of a property before closing is essential. The article highlights how a comprehensive homebuyers survey can expose hidden issues, provide negotiation leverage, and prevent costly surprises. If you want clear, detailed insights into structural integrity, moisture concerns, electrical safety, and more, choosing the right inspection partner is critical.

At Trinity Home Inspections, we bring InterNACHI-certified expertise combined with modern technology like free thermal imaging, drone roof inspections, and detailed same-day photo and video reports. Our faith-based commitment to honesty and integrity means you receive straightforward answers and actionable guidance, helping you make confident decisions with no hidden details. Whether you need a basic condition report or a full building survey, we tailor our services to your unique property needs.

Don’t leave your home purchase to chance. Visit Trinity Home Inspections now to schedule your professional homebuyers survey and gain the clarity and protection you deserve. Explore our same-day reports and actionable insights and discover how we support homebuyers throughout Baldwin, Mobile, and the Greater Gulf Coast areas.

Frequently Asked Questions

What is the purpose of a homebuyers survey?

A homebuyers survey is designed to provide a detailed examination of a property’s condition, uncovering potential issues that may not be visible during a standard walkthrough. This helps buyers make informed decisions and protects them from unexpected costs after the purchase.

What types of homebuyers surveys are available?

There are several types of homebuyers surveys, including Condition Reports, Homebuyer Surveys, Building Surveys, and Specific Purpose Surveys. Each type varies in depth and detail, catering to different property needs and buyer requirements.

How does the homebuyers survey process work?

The homebuyers survey process typically includes an initial consultation to discuss concerns, preparation of the property for inspection, a thorough physical examination, report generation, and a review of the results to understand the implications and next steps.

What are the key benefits of conducting a homebuyers survey?

Key benefits include transparency in uncovering hidden issues, financial protection against costly repairs, increased negotiation power for price adjustments, risk mitigation for long-term maintenance, and informed decision-making regarding the property investment.

Recommended